Longevity Biotech Landscape

Navigating the idea maze of longevity biotech can be a daunting task. Although comprehensive databases like Longevity List and AgingBiotech.info offer valuable information on various companies, it is still challenging to see the big picture and identify established or unexplored paths. To pinpoint such areas, it’s important to know what strategies there are and which have not been explored commercially – information not reflected in the databases.

To address these challenges, this post aims to provide a survey of all different scientific approaches in longevity biotech. Beginning with a broad overview of the entire landscape, we will delve deeper into each approach and scope out under-explored areas with promising potential.

1. landscape overview

1.1. Framework for categorization

There are four paradigms for longevity biotech therapeutics:

Reset and Repair: This paradigm focuses on targeting specific, known age-related pathways, factors, or damages identified in hallmarks of aging (2023) (with some modifications)

Replace: Falling within the domain of regenerative medicine, this paradigm includes the replacement of aged cells, tissues, organs, or even the whole body with younger counterparts or endogenous regeneration.

Reprogram: This paradigm is inspired by the natural rejuvenation process that occurs during early embryonic development, which enables the production of youthful offspring from old gametes. It aims to activate a similar embryonic-like program within aged cells, without altering their cell identity, through a process known as partial reprogramming.

Discover: This paradigm focuses on identifying novel targets or interventions for aging by analyzing extensive datasets using advanced machine learning techniques. As companies here mature, they may eventually align with one or more categories in "Reset and Repair" or create a new category as their targets become more defined.

Figure 1: Visual representation of the four main longevity biotech paradigms

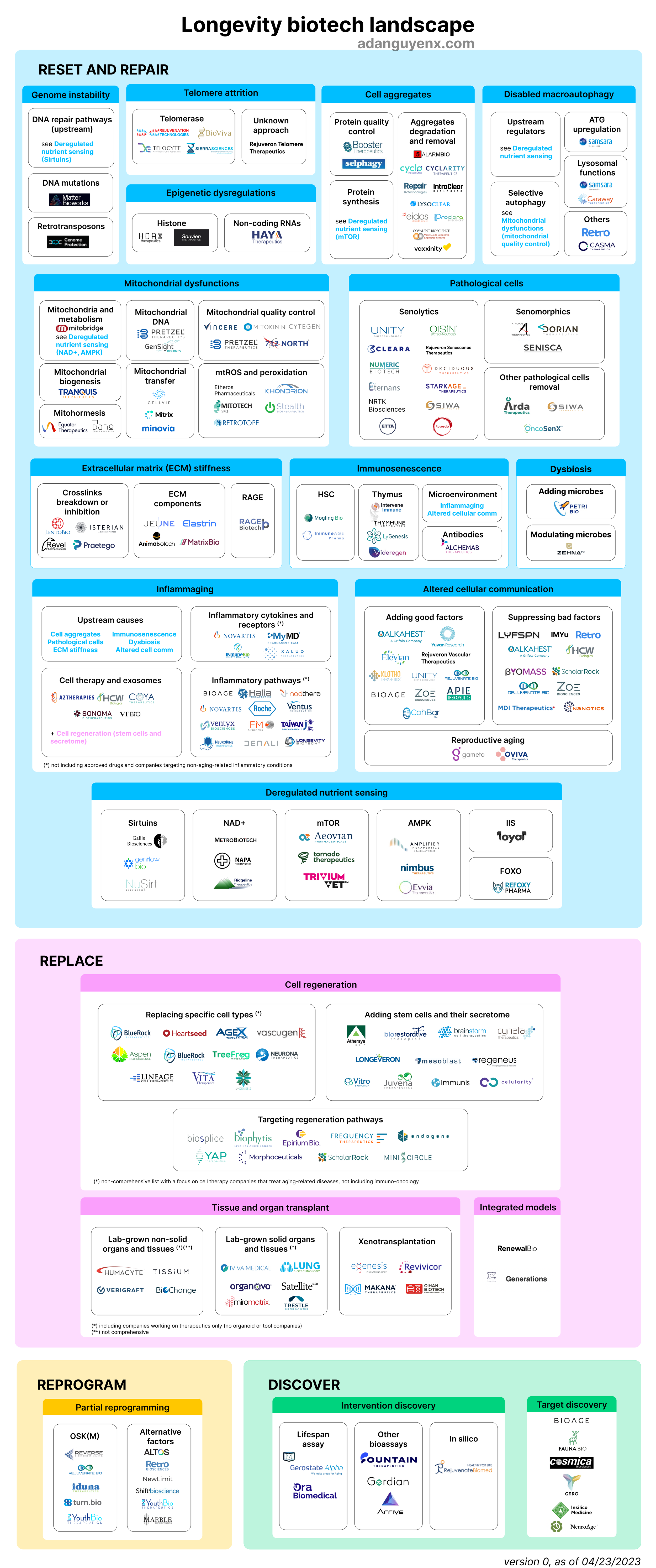

1.2. market map

Below is a market map of all 100+ longevity biotech companies organized into different paradigms, categories, and subcategories. The data is sourced from Longevity List and AgingBiotech.info (Tx only), with exclusions and additions from my own research. The definition of a longevity biotech company is further explained in Section 1.3.

Figure 2. Market map of all longevity biotech companies

1.3. longevity biotech definition

Within the scope of this post, excluding companies in cryonics, diagnostics, dietary supplements, nutraceuticals, and topical cosmetics, longevity biotech companies are those that:

Target mechanisms of aging or pathological manifestations that underlie various age-related diseases and affect multiple organs or systems, or

Focus on regenerative medicine

To better understand these points, let's delve deeper into each aspect below.

Mechanisms of aging

Most people in the field agree with the geroscience hypothesis, which posits that a few underlying causal mechanisms drive many age-related diseases and phenotypes. However, there is disagreement on what these core causal mechanisms actually are:

- • SENS categories identify seven types of damage as the main causes of aging

- • Others believe that the core pathways regulating lifespan are the evolutionarily conserved metabolic pathways (Pan and Finkel 2017)

- • The information theory of aging argues that the primary cause of aging is DNA damage, which drives genetic and epigenetic loss of information (Yang et al. 2023)

- • The programmatic theory of aging suggests that aging results from design flaws in developmental software encoded in the epigenome (de Magalhães 2023)

- • … and many more

Due to these differing opinions on the root causes of aging, it is difficult to define exactly what targeting aging means. For example, a supporter of the SENS approach might argue that focusing on epigenetics and metabolism merely addresses the consequences of damage and does not provide a path to preventing or reversing aging, i.e. not truly targeting a mechanism of aging. How then, can we determine which companies qualify as true longevity biotech companies?

To achieve a holistic picture of the field, adopting a neutral stance is key. I have found that the list from Hallmarks of Aging (2023) offers a fairly comprehensive overview of the various mechanisms of aging and age-related pathological manifestations (elaborated in section 1.4). As such, any processes documented in Hallmarks of Aging (2023) will count as a mechanism of aging in our definition.

Underlying various age-related diseases and multiple organs or systems

A company must target aging mechanisms or pathological manifestations relevant to multiple age-related diseases and organ systems to be considered a longevity biotech. This means that:

- • Companies treating only one age-related disease don't qualify unless their approach has potential for treating other age-related diseases.

- • Companies targeting an aging mechanism in one organ system aren't included unless the mechanism applies to other systems. For example, Cerevance is a CNS company that does not qualify as a longevity biotech company, since their targets are largely limited to the nervous system (orexin receptor, KCNK13). On the other hand, Ventus Therapeutics qualifies because NLRP3 inflammasome is applicable to multiple systems.

- • Companies targeting an aging mechanism but initially focusing on a non-age-related disease can still qualify if its therapy or platform is likely to improve multiple age-related diseases in multiple organ systems. An exception to this rule is companies in the "Inflammaging" category; due to the crowded nature of this space, they must explicitly target one or more age-related diseases to qualify.

Regenerative medicine

Regenerative medicine is a branch of medicine that focuses on restoring the structure and function of damaged cells, tissues, organs, or even the whole body by replacing them with younger, functional counterparts. As a result, most regenerative medicine companies are considered longevity biotech companies that fall into the "Replace" paradigm, with some exceptions. Those that only offer tools like organoids and 3D bioprinting without creating specific therapeutic products, or companies without products seeking FDA approval (e.g. stem cell clinics), do not qualify as longevity biotech.

Due to the extensive nature of this category, the featured companies in the “Replace” paradigm represent a sample rather than a comprehensive list, with a focus on companies explicitly going after age-related indications.

1.4. notes on categorization

“All models are wrong, but some are useful.”

Categorizing the various approaches to addressing aging is a challenging task, particularly because aging is an interconnected process. Below I will explain some of the reasoning behind the categorization.

“Reset and Repair”

"Reset and Repair" encompasses companies that focus on targeting specific, known age-related factors, pathways, and damages, which have been documented by various frameworks, including hallmarks of aging (2023), pillars of aging, and SENS categories.

There is significant overlap among these three frameworks, as documented by Karl Pfleger here. As seen in Karl’s table, hallmarks of aging (2023) is the most extensive and covers almost all factors present in SENS categories and pillars of aging. Therefore, the categories in “Reset and Repair” are based on the hallmarks of aging (2023) with a few modifications:

- • "Loss of proteostasis" is replaced by "Cell aggregates" for a broader term, which covers both intracellular and extracellular aggregates

- • "Senescent cells" is changed to "Pathological cells" to encompass various cell types contributing to aging

- • “ECM” and “immunosenescence,” grouped under "Altered cellular communication" and "Chronic inflammation" in hallmarks of aging (2023), become separate subcategories

- • “Stem cell exhaustion” is not included since companies targeting this hallmark belong to the "Replace" category

At the same time, hallmarks of aging are far from comprehensive as our understanding of aging is constantly evolving. Gems and de Magalhaes (2021) critiqued the first version of the hallmarks of aging (2013) for being somewhat arbitrary, as it omitted factors like inflammaging, mechanical senescence, immunosenescence, and dysbiosis. The updated hallmarks of aging now include these, with the acknowledgment that the list may still be incomplete.

Despite any limitations, all current longevity biotech companies in “Reset and Repair” can fit into the updated hallmarks, so for now they provide a sufficient framework for the categories in "Reset and Repair."

“Replace”

See “Regenerative medicine” in section 1.3.

“Reprogram”

Partial reprogramming is often referred to as epigenetic reprogramming, so some may question why it is categorized as a separate paradigm rather than being included in the "epigenetic alterations" category of "Reset and Repair." My reasonings are as follows:

- • Partial reprogramming represents a distinctive paradigm from “Reset and Repair.” The latter relies on addressing individual age-related changes or damages, whereas the former employs a potentially universal rejuvenation program that can affect multiple aspects of aging simultaneously.

- • Partial reprogramming has demonstrated its ability to ameliorate several hallmarks of aging, so limiting its classification to just epigenetic alterations would not accurately represent its broader impact on the aging process.

“Discover”

Instead of focusing on specific hallmarks like “Reset and Repair” companies, the ones in this paradigm focus on discovering new targets and interventions in a category-agnostic manner. As these companies advance in their development, they may eventually align with one or more categories in "Reset and Repair" or create a new category as their targets become more defined.

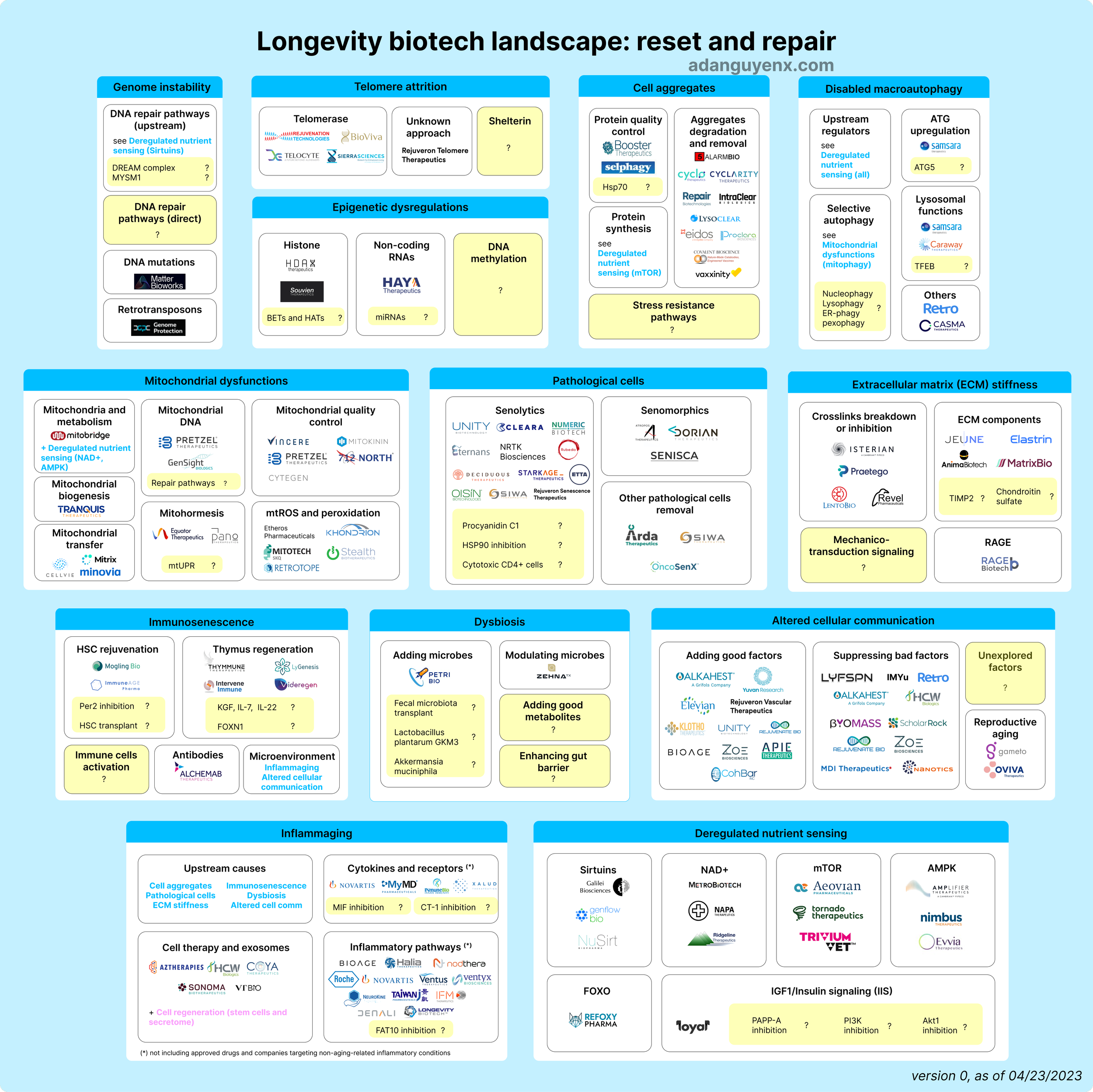

2. reset & repair

Now let us take a closer look at each paradigm, starting with “Reset and Repair.” As explained in section 1.4, in this paradigm, longevity therapeutics are developed by targeting specific age-related pathways, factors, or damages. These age-related elements can be grouped into 13 categories, similar to the hallmarks of aging (2023) (with some modifications).

Figure 3 below provides a more detailed market map of this paradigm, where the areas highlighted in yellow represent untapped opportunities by existing companies.

In the following subsections, I will go into a deeper dive of each category within “Reset and Repair” — elucidating the research supporting both current and unexplored strategies. Subsections in italic will be published at a later date.

Telomere attrition

Epigenetic alterations

Cell aggregates

Mitochondrial dysfunctions

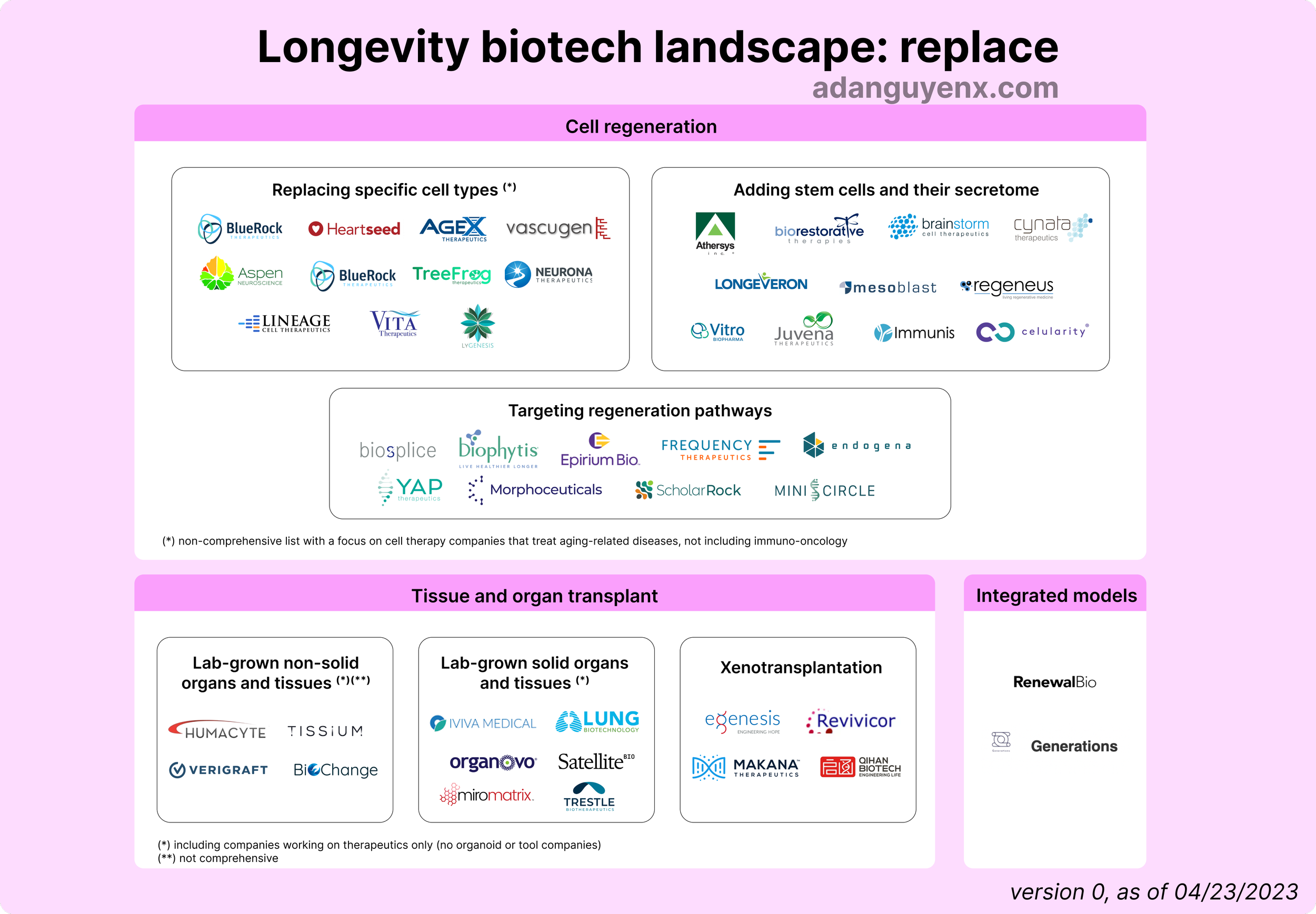

3. replace

The “Replace” approach includes the replacement of aged cells, tissues, organs, or even the whole body and falls within the domain of regenerative medicine. For an overall view of replacement as a strategy, Jean Hébert’s Replacing Aging and Nathan Cheng’s book notes are good places to start.

In theory, replacement makes perfect sense: if you think of the body as a machine, replacing old parts with new ones should extend lifespan. At the same time, it is a lot more complicated due to the major role that the body’s environment plays. In an ideal case, more organs need to be replaced simultaneously or within a short period to avoid the new organs being negatively affected by old organs. In addition, unlike “Reset and Repair,” studies on the lifespan extension effect of replacement approaches are sparse. The closest proof of concept for replacement is HSC and serial thymus transplantations (Kovina et al. 2019, Guderyon et al. 2020, Hirokawa and Utsuyama 1984), which extend lifespan due to decreased immunosenescence. To my knowledge, there have been no studies that transplant solid organs as a means to extend lifespan yet.

The “Replace” approach primarily involves overcoming engineering obstacles, such as the manufacturing and scaling of cell production, controlling cell behavior, developing vascularization, among other aspects. The area of biology for replacement falls outside the conventional scope of longevity research and encompasses various disciplines, including synthetic biology and tissue engineering. Identifying unexplored areas in this approach proves to be more difficult, given the vast potential for exploration within this wide-open domain. Therefore, unlike previous sections, instead of pinpointing underexplored areas, the focus will be on understanding the current approaches and their implications.

In the following subsections, I will go into a deeper dive of each category in “Replace.” Subsections in italic will be published at a later date.

Cell regeneration

Tissue and organ transplant

Artificial embryos

4. reprogram

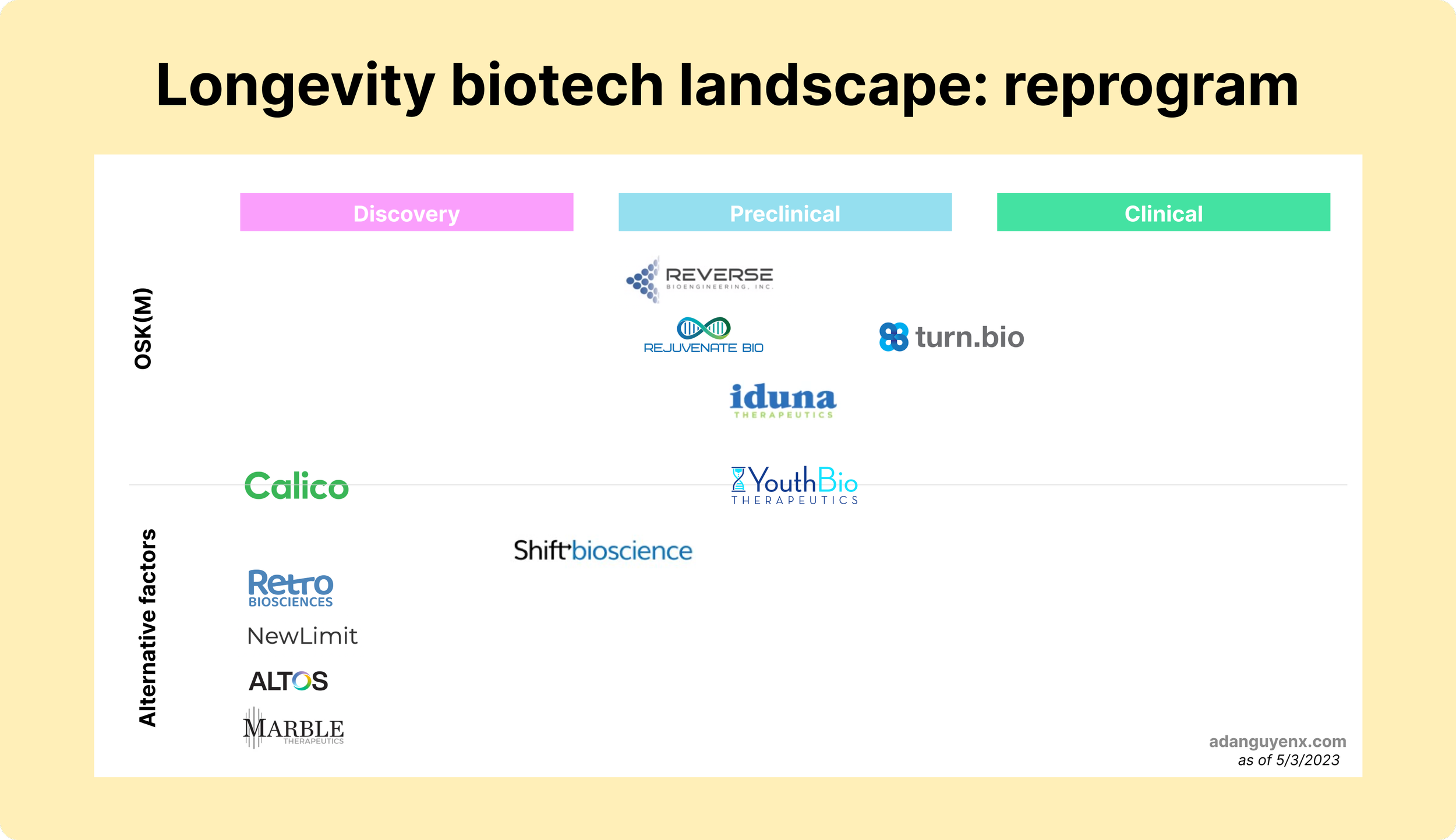

Figure 5. Overview of “Reprogram” companies and their development stage

I’ve written extensively about partial reprogramming companies below.

In this paradigm, there are few underexplored approaches, as many companies are already pursuing alternative factors for reprogramming. These companies tend to be secretive about their methods, making it difficult to ascertain their exact processes, but it’s likely that they employ machine learning-guided high-throughput screening on one of these sources for alternative factors.

5. Discover

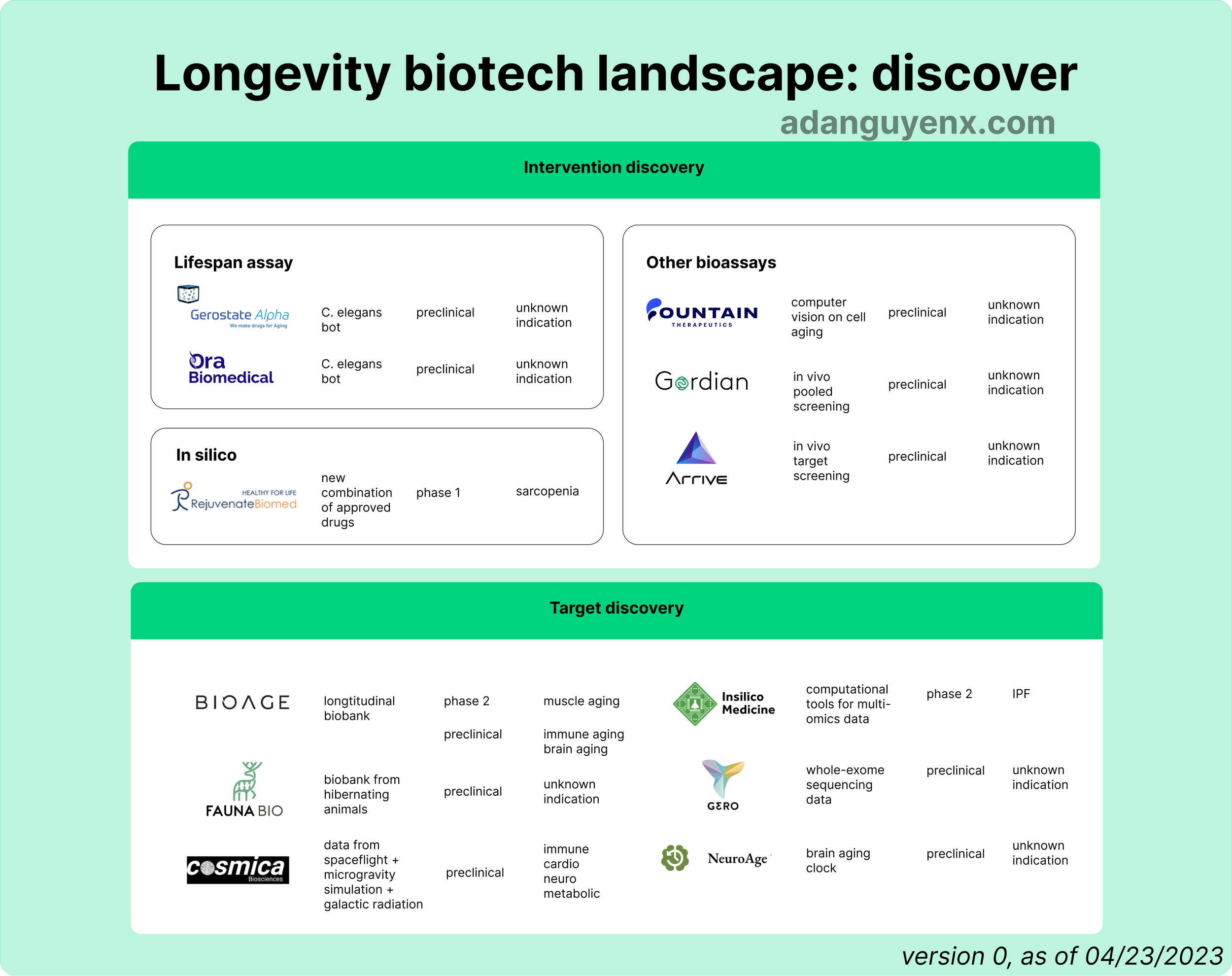

Companies using the “Discover” approach are usually grouped as “AI drug discovery” companies, but I want to make a distinction between two categories: Intervention and Target Discovery.

Intervention Discovery companies begin by sourcing compounds from various origins and conducting high-throughput screening using a range of assays related to aging. These assays may include in silico (Rejuvenate Biomed), cellular aging (Fountain Therapeutics), or even lifespan assays (Gerostate Alpha and Ora Biomedical). The moat of these companies lies in their proprietary methods for developing these assays to screen possible compounds.

On the other hand, Target Discovery companies operate one step earlier in the process. These companies typically possess large datasets, which they analyze using AI/ML to uncover new targets related to aging. Their competitive advantage stems from their rich datasets (BioAge) or datasets from unique sources (Fauna Bio, Cosmica), and/or the advanced computational techniques they employ to discover new targets.

AI drug discovery is a vast field outside the scope of just longevity biotech. There are still many uncharted territories which are impossible to list exhaustively. These include the development of new computational methods, the identification of novel targets, or the discovery of unique therapeutic sources. A few ideas come to mind:

Alternative therapeutic sources: Investigating novel molecules and modalities from unconventional natural sources may prove beneficial. Elliot Hergshberg's Extreme Biology emphasizes that this approach has led to the discovery of some of our most effective medicines, with several biotech startups beyond the longevity biotech sector adopting this strategy.

Untapped targets: A significant number of aging-associated genes and pathways remain unaddressed through pharmacological methods, despite our knowledge of over 2,000 genes that impact longevity in model organisms (de Magalhães et al. 2017). AgingBiotech.Info's aging databases could serve as a valuable starting point for investigation in this area

There are many diverse scientific approaches in longevity biotech, but ultimately they can be distilled into four paradigms: reset and repair, replace, reprogram, or discover. As we’ve seen throughout the sections, there is still an abundance of untapped opportunities in each paradigm, leaving several avenues for commercial development. I’ve tried to be as comprehensive as I can in covering all available strategies, but some may still have been overlooked. Feedback welcome, especially regarding any additional approaches, targets, or companies not yet covered here.

Compared to other biotech sectors such as oncology, longevity biotech is still in its infancy, both in terms of funding and the number of companies involved, despite the potential it holds to tackle the leading cause of death – aging. In creating this landscape, my aim is to provide a structured approach to identify and address the lesser-known approaches within this field. As a starting point, consider which paradigm you'd like to see expanded, and go deeper there to find new opportunities for company formation or investment. It’s time to build and let 1000 longevity biotech companies bloom.